Answer the following statements true (T) or false (F)

1. The tax base is the percentage at which the tax is levied.

2. A sales tax is sometimes said to be regressive because the rate at which it is assessed declines as more and more taxable items are purchased.

3. The sales tax is proportional with respect to the tax base of the amount of purchases.

4. Automobile license fees and gasoline taxes are based on the benefit-received theory of taxation.

5. An excise tax can be shifted relatively easily.

1. FALSE

2. FALSE

3. TRUE

4. TRUE

5. TRUE

You might also like to view...

There is an average price for a used car that accounts for both good used cars and bad used cars ("lemons"). At the current market price for used cars, the persons __________ likely to offer their used cars for sale are people who own __________.

A. most; "lemons" B. least; good used cars C. least; "lemons" D. a and b E. There is not enough information to answer the question.

A recessionary gap exists when potential GDP

A. falls short of equilibrium GDP. B. exceeds equilibrium GDP. C. equals equilibrium GDP. D. inflation leads to economic disequilibrium.

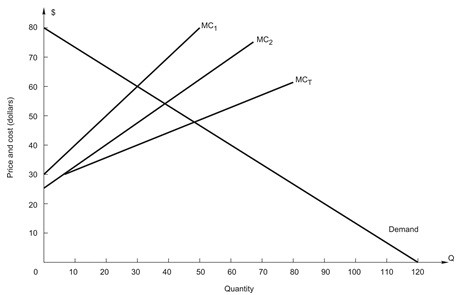

The figure above shows the demand and cost conditions for a firm with two plants. How should the firm allocate total output between the two plants in order to maximize profit?

The figure above shows the demand and cost conditions for a firm with two plants. How should the firm allocate total output between the two plants in order to maximize profit?

A. produce 30 units in plant 1, 20 units in plant 2 B. produce 10 units in plant 1, 20 units in plant 2 C. produce 40 units in plant 1, 40 units in plant 2 D. produce 40 units in plant 1, 50 units in plant 2 E. produce 55 units in plant 1, 60 units in plant 2

The marginal cost is the cost of ______.

a. inefficiency and waste while producing a good b. taxes levied on the production of a good c. producing all of the units of a good d. producing one more unit of a good.