Raising the discount rate is:

a. an expansionary policy because it raises the ratio of excess to total reserves in the banking system

b. a contractionary policy on the part of the member banks of the Fed because it raises the firms' costs of borrowing from them.

c. a contractionary policy on the part of the Fed because it raises the commercial banks' cost of borrowing from it.

d. an expansionary policy on the part of the member banks of the Fed because it raises their profits relative to those of the nonmember banks.

e. an expansionary policy on the part of the Fed because increasing the interest rates that the banks are allowed to charge will increase their willingness to make loans.

c

You might also like to view...

Refer to the scenario above. What is likely to be the impact on Firm A's sales if both the firms decide to sponsor the event?

A) A 5% increase in sales B) A 2% increase in sales C) A 0% increase in sales D) A 10% increase in sales

If consumption increases by $400 when income increases by $500, then the marginal propensity to consume is

A) 900. B) 100. C) 1.20. D) 0.80.

Which of the following is an example of money serving as a medium of exchange? a. John buys a cup of coffee and a roll at the faculty dining room. b. Steve puts a five-dollar bill in his money belt

c. Scott deposits cash into a savings account. d. Roland puts his coins into a piggy bank.

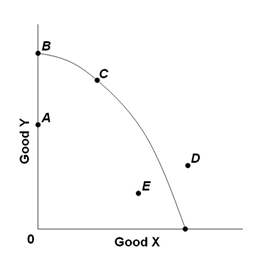

The graph below shows the production possibilities curve for an economy producing two goods, X and Y. All of the following may allow the economy to produce combination D in the future, except?

A. Lower unemployment

B. Increasing labor supply

C. Economic growth

D. Technological advances