Which of the following would reduce the money supply?

A. Commercial banks use excess reserves to buy government bonds from the public.

B. Commercial banks loan out excess reserves.

C. Commercial banks sell government bonds to the public.

D. A check clears from Bank A to Bank B.

C. Commercial banks sell government bonds to the public.

You might also like to view...

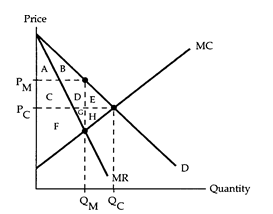

Refer to the market diagram. Of the surplus that the consumers lose because there is a monopoly (and not perfect competition), how much has become deadweight loss?

The following questions refer to the accompanying market diagram. PC and QC are the equilibrium price and quantity if the firm behaves competitively, and PM and QM are the equilibrium price and quantity if the firm is a simple monopoly.

a. Area E

b. Area H

c. Area E + H

d. Area C + D + H

The dependency burden is

a. a measure of the degree to which the less developed countries are dependent on the rich industrial countries. b. the average number of children that a woman gives birth to during her lifetime. c. the number of babies born per 1000 persons. d. the percent of the population that is below 15 and above 65 years of age.

The total market value of capital assets in the United States is about $30 trillion dollars

a. True b. False Indicate whether the statement is true or false

In 2011, the poverty line for a family of four in the U.S. was

a. $60,974. b. $23,021. c. $20,988. d. $17,642.