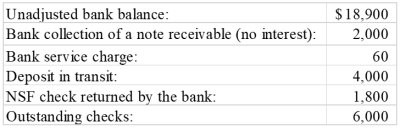

The following information pertains to the bank reconciliation as of January, 31 for the Greis Company: In addition, the reconciliation revealed one error: Check #2146 for $152, written to pay utilities expense, was incorrectly recorded in the books for $125.Required:Using the above information, determine the unadjusted book balance for cash.

In addition, the reconciliation revealed one error: Check #2146 for $152, written to pay utilities expense, was incorrectly recorded in the books for $125.Required:Using the above information, determine the unadjusted book balance for cash.

What will be an ideal response?

$16,787

True cash balance = Unadjusted bank balance of $18,900 + Deposit in transit of $4,000 ? Outstanding checks of $6,000 = $16,900

True cash balance of $16,900 = Unadjusted book balance (the unknown)

+ Collection of the accounts receivable of $2,000 ? Service charge of $60 ? NSF check of $1,800 ? Error recording Check #2146 of $27

Unadjusted book balance = $16,900 ? $2,000 + $60 + $1,800 + $27 = $16,787

The error in recording Check #2146 caused cash to be overstated by $27, which is the difference between the actual amount of check of $152 and the amount recorded of $125. To correct this error, the company must decrease the book balance.

You might also like to view...

A brief personal message written to comfort someone is referred to as? a(n) ____________ letter.

A. condolence B. reference C. referral D. recommendation E. adjustment

The use of self-directed teams to respond to competitive advantage is decreasing due to better communications through technology

Indicate whether the statement is true or false

A(n) _____ with a modem is very slow (usually no faster than 56 Kbps), so most users and small businesses today are turning to faster connections that use digital signals throughout the connection, such as DSL and cable connections.

Fill in the blank(s) with the appropriate word(s).

________ explains changes in the owner's claim on the business's assets from net income or loss, owner investments, and owner withdrawals over a period of time.

What will be an ideal response?