Suppose the federal government implemented a flat tax to replace the income tax, and the flat tax saved taxpayers a total of $5 billion. A tax change such as this could be viewed as an example of the federal government implementing

A) contractionary monetary policy. B) contractionary fiscal policy.

C) expansionary monetary policy. D) expansionary fiscal policy.

D

You might also like to view...

In the figure above, if the government provides a subsidy to colleges of $6,000 per student per year, what is the tuition?

A) $10,000 per year B) $12,000 per year C) $8,000 per year D) $6,000 per year

A decrease in the foreign interest rate causes the demand for domestic assets to ________ and the domestic currency to ________, everything else held constant

A) increase; appreciate B) increase; depreciate C) decrease; appreciate D) decrease; depreciate

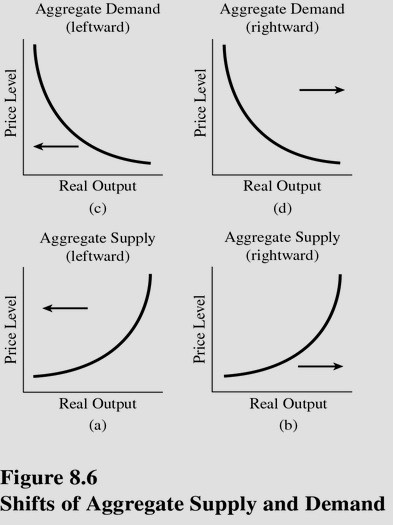

Choose the letter below that best represents the type of shift that would occur in the following situation in the United States: OPEC raises the price of its oil significantly. (See Figure 8.6.)

Choose the letter below that best represents the type of shift that would occur in the following situation in the United States: OPEC raises the price of its oil significantly. (See Figure 8.6.)

A. A. B. B. C. C. D. D.

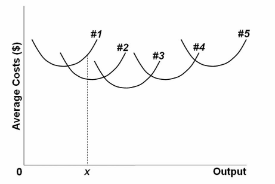

The diagram shows the short-run average total cost curves for five different plant sizes of a firm. The shape of each individual curve reflects:

A. increasing returns, followed by diminishing returns.

B. economies of scale, followed by diseconomies of scale.

C. constant costs.

D. increasing costs, followed by decreasing costs.