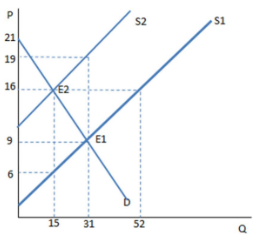

Suppose a tax on sellers has been imposed as shown in the graph. Once the tax is in place, the buyers experience:

A. a decrease in demand.

B. an increase in demand.

C. a decrease in quantity demanded.

D. an increase in quantity demanded.

C. a decrease in quantity demanded.

You might also like to view...

Suppose that along a linear demand curve, the elasticity of demand is equal to 1 when the price is $4 and the quantity is 100 units. Then the

A) total revenue is at its maximum when 100 units are produced. B) marginal revenue is positive at 100 units. C) marginal revenue is negative at 100 units. D) Both answers A and B are correct. E) Both answers A and C are correct.

Which of the following is NOT a factor of production?

A) mineral resources B) a university professor C) an apartment building D) 100 shares of Microsoft stock

According to the total revenue test, a price cut increases total revenue if demand is

A) inelastic. B) perfectly inelastic. C) elastic. D) unit elastic.

Which of the following would make the equilibrium real interest rate decrease and the equilibrium quantity of loanable funds increase?

a. The demand for loanable funds shifts right. b. The demand for loanable funds shifts left c. The supply of loanable funds shifts right. d. The supply of loanable funds shifts left.