Assume that the central bank increases the reserve requirement. If the nation has low mobility international capital markets and a flexible exchange rate system, what happens to the real risk-free interest rate and the nominal value of the domestic currency in the context of the Three-Sector-Model?

a. The real risk-free interest rate rises, and nominal value of the domestic currency falls.

b. The real risk-free interest rate falls, and nominal value of the domestic currency falls.

c. The real risk-free interest rate rises, and nominal value of the domestic currency remains the same.

d. The real risk-free interest rate rises, and nominal value of the domestic currency rises.

e. There is not enough information to determine what happens to these two macroeconomic variables.

.D

You might also like to view...

What are some of the potential obstacles that can prevent a market from reaching the efficient outcome? Briefly define each obstacle

What will be an ideal response?

Advocates of flexible exchange rates claim that under flexible exchange rates

A) enhanced control over fiscal policy would allow countries to dismantle their distorting barriers to international payments. B) reduced control over monetary policy would allow countries to dismantle their distorting barriers to international payments. C) enhanced control over monetary policy would allow countries to increase their distorting barriers to international payments. D) enhanced control over monetary policy would allow countries to dismantle their distorting barriers to international payments. E) enhanced control over monetary policy would destabilize exchange rates.

If a recessionary GDP gap exists, which of the following sets of policies should the Federal Reserve Board pursue?

A. Sell government securities, lower the discount rate, and lower the required reserve ratio. B. Sell government securities, lower the discount rate, and raise the required reserve ratio. C. Buy government securities, raise the discount rate, and lower the required reserve ratio. D. Buy government securities, lower the discount rate, and lower the required reserve ratio.

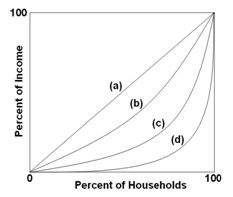

Refer to the below graph. If the Lorenz curve shifted from (d) to (b), then the Gini ratio and the degree of income inequality would:

A. Increase

B. Decrease

C. Remain constant

D. Become negative