A monopolist earns $50 million annually and will maintain that level of profit indefinitely, provided no other firm enters the market. If another firm successfully enters the market, the incumbent's profits remain at $50 million the first period, but fall to $25 million annually thereafter. The opportunity cost of funds is 10 percent, and profits in each period are realized at the beginning of each period. What is the present value of the firm's current and future earnings if entry occurs?

A. $250 million

B. $400 million

C. $300 million

D. $500 million

Answer: C

You might also like to view...

The above table gives some production and cost information for Flaming Fernando's, a restaurant that sells Fiery Frijoles. What is the average total cost of producing 4,500 frijoles?

A) $2 B) $225 C) $9000 D) More information is needed to determine the answer.

Which of the following is true of fiscal spending at the federal, state, and local levels of the U.S. government?

a. In 2009, total government spending equalled around $1 billion. b. Investment expenditure in the U.S. exceeds the total spending at all levels of government. c. Government spending at federal, state, and local levels declined steadily from the 1960s until about 1980. d. Through the 1950s and 1960s, the U.S. government maintained a balanced budget. e. Federal government spending exceeds state and local government spending in the U.S.

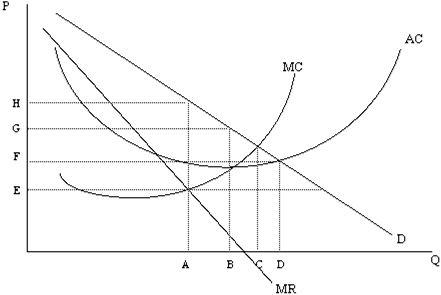

Figure 11-2

In Figure 11-2, at what quantity would the monopolist maximize profit?

a.

A

b.

B

c.

C

d.

D

An economy with an expansionary gap will, in the absence of stabilization policy, eventually experience a(n) ________ in the inflation rate, leading to a(n) ________ in output.

A. decrease; increase B. increase; increase C. decrease; decrease D. increase; decrease