Is the distribution made from current or accumulated E&P? At the beginning of 2011, what is accumulated E&P?

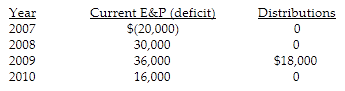

Omega Corporation is formed in 2006. Its current E&P and distributions for each year through 2010 are as follows:

The $18,000 distribution is made from 2009's current E&P. At the beginning of 2010, Omega's accumulated E&P is $28,000, (-$20,000 + $30,000 + $36,000 - $18,000). At the beginning of 2011, Omega's accumulated E&P is $44,000, ($28,000 + $16,000).

You might also like to view...

The net income of a company for the year was $500,000. The company has no preferred stock. Common stockholders' equity was $1,200,000 at the beginning of the year and $2,300,000 at the end of the year. Calculate the rate of return on common stockholders' equity. (Round your answer to two decimal places.)

A) 21.74% B) 17.86% C) 41.67% D) 28.57%

What should a confidentiality agreement signed by ethics training participants stipulate?

a. The content raised during the training can be discussed among participants of the training after training is completed. b. Confidentiality of training discussion is recommended. c. Violation of confidentiality will result in employment termination. d. Violation of confidentiality can negatively impact performance evaluations.

Interest payment on long–term borrowing is classified as a(n):

a. noncash activity. b. financing activity. c. investing activity. d. operating activity.

A primary purpose of vertical analysis is to observe trends over a three-year period

Indicate whether the statement is true or false