The All-Mine Corporation is deciding whether to invest in a new one-year project. The project would have to be financed by equity, the cost is $2,000, and the return will be a guaranteed $2,500 in one year. The discount rate for both bonds and stock is 15 percent and the tax rate is zero. The predicted cash flows excluding this new project are $4,500 in a good economy, $3,000 in an average economy, and $1,000 in a poor economy. Each economic outcome is equally likely to occur and the promised debt repayment is $3,000. Should the company take the project? What is the value of the firm and its debt and equity components before and after the project addition?

What will be an ideal response?

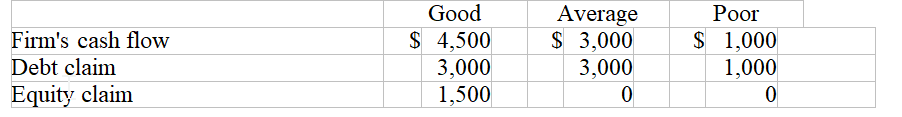

Values prior to the new project:

Value of debt = [($3,000 + 3,000 + 1,000)/3]/1.15

Value of debt = $2,028.99

Value of equity = [($1,500 + 0 + 0)/3]/1.15

Value of equity = $434.78

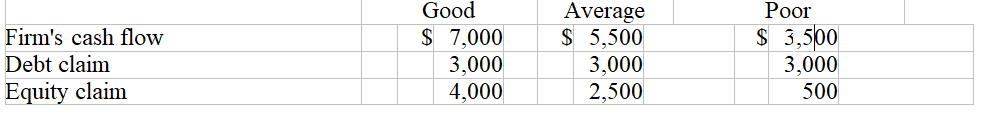

Values with the new project:

Value of debt = [($3,000 + 3,000 + 3,000)/3]/1.15

Value of debt = $2,608.70

Value of equity = [($4,000 + 2,500 + 500)/3]/1.15

Value of equity = $2,028.99

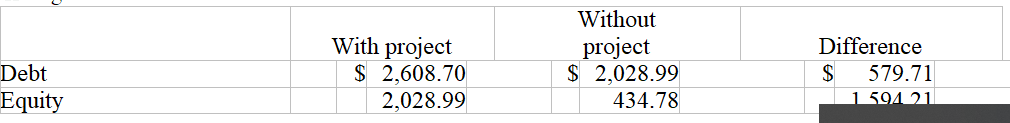

Changes in value:

NPV to shareholders = $1,594.21 ? 2,000

NPV to shareholders = ?$405.79

If the firm keeps shareholder value as it primary goal, which it should, then the firm should reject the project as it has a negative NPV for the shareholders.

You might also like to view...

A company with a high level of operating leverage will:

A) experience fewer fluctuations in income as sales fluctuate than a company with a low level of operating leverage. B) experience wider fluctuations in income as sales fluctuate than a company with a low level of operating leverage. C) earn higher profits than a company with a low level of operating leverage. D) earn lower profits than a company with a low level of operating leverage.

Explain the right of performance

What will be an ideal response?

A special form of insurance primarily on mortgages for single-family loans, allowing the buyer to borrow more by putting down a smaller down-payment is called Private Mortgage Insurance (PMI).?

Indicate whether the statement is true or false

As the owner of a business, quickly admitting that the firm is in trouble indicates a lack of accountability.

Answer the following statement true (T) or false (F)