The potential for a financial breakdown at large institutions to spread throughout the financial system is called

A. a systemic risk.

B. a too-large-to-fail problem.

C. a moral hazard.

D. an averse selection problem.

Answer: A

You might also like to view...

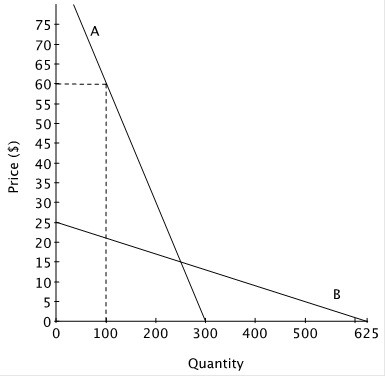

Suppose that a new drug has been approved to treat a life-threatening disease. The demand for that drug is shown on the graph below. Prior to approval of this drug, the only treatment for this condition was any one of several non-prescription, or over-the-counter, pain relievers. The demand for one brand of the several non-prescription pain relievers is also shown on the graph.  The manufacturer of the over-the-counter pain reliever would ________ total revenue by increasing the price from $15 to $16.

The manufacturer of the over-the-counter pain reliever would ________ total revenue by increasing the price from $15 to $16.

A. experience an uncertain change in B. experience no change in C. increase D. decrease

The largest expenditure category in the United States is

A) consumption expenditure. B) wages. C) net exports of goods and services. D) government expenditure on goods and services. E) investment.

In the figure above, suppose the price of a pound of pecans is negatively related to the quantity of peanuts that farmers are willing to supply. If the price of pecans increases

A) the curve will shift rightward. B) the curve will shift leftward. C) there is a movement along the curve. D) the curve will be unaffected.

For most of U.S. modern economic history, when the unemployment rate is _______, real GDP is _________.

A) falling; rising b) falling; falling C) rising; unchanged D) rising; rising