The tax brackets in a particular year are 10% on earnings up to $35,000, 20% on earnings from $35,001 to $75,000, 30% on earnings from $75,001 to $150,000, and 33% on earnings over $150,000. If Professor Schmidt earns $125,000, what is her marginal tax rate?

a. 10%

b. 27%

c. 30%

d. 60%

c. 30%

You might also like to view...

Other things remaining unchanged, which of the following is most likely to cause an increase in the demand for personal computers?

a. A reduction in the price of personal computers b. An increase in the supply of personal computers c. An increase in the cost of computer printing ink d. An increase in the number of computer manufacturers e. A requirement by universities that all students buy personal computers

Use the following table to answer the question below. Price per UnitQuantity Demanded per YearQuantity Supplied per Year$52,0000101,800300151,600600201,400900251,2001,200301,0001,500There will be a shortage whenever the price is

A. higher than $25. B. equals $25. C. higher than $30. D. lower than $25.

What is a multilateral exchange rate?

a. It is an exchange rate that is measured by using a number of different techniques. b. It is an exchange rate that calculates the overall movement of the rate against more than just one other currency. c. It is an exchange rate that is measured once every 10 years. d. It is a rate that is set by the IMF for many different nations.

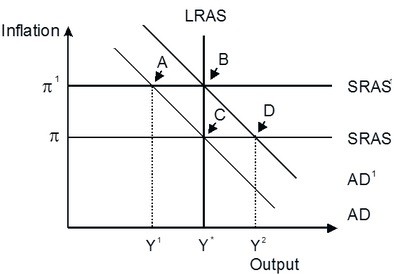

Refer to the accompanying figure. An economy is currently in long-run equilibrium at point B, at an inflation rate of ?', which is too high for to sustain economic growth. If an anti-inflationary policy is enacted, the economy will be in short-run equilibrium at point ________ and eventually to a long-run equilibrium at point ________.

An economy is currently in long-run equilibrium at point B, at an inflation rate of ?', which is too high for to sustain economic growth. If an anti-inflationary policy is enacted, the economy will be in short-run equilibrium at point ________ and eventually to a long-run equilibrium at point ________.

A. A; B B. B; C C. A; C D. B; A