If the banking system has demand deposits of $100,000, total reserves equal to $20,000, and a required reserve ratio of 20 percent, the banking system can increase the volume of loans by

A. $80,000.

B. $100,000.

C. $20,000.

D. $0.

Answer: D

You might also like to view...

In an open economy with flexible exchange rates, monetary policy affects ________ through changes in the real interest rate and affects ________ through changes in the exchange rate.

A. taxes and saving; net exports B. consumption and investment; net exports C. net exports; taxes and saving D. productivity and growth; consumption

The concept of choosing the least-cost combination of resources for a given amount of output is known as

a. technical efficiency. b. the principle of diminishing marginal returns. c. economic efficiency. d. decreasing returns to scale.

Consider Sam and Linda both drive a relatively inefficient sport utility vehicle (SUV). Sam has a lease that doesn't expire for three years whereas Linda owns her sport utility vehicle free and clear. If the price of gasoline was to increase by fifty percent, which of these statements is most likely TRUE?

A) Linda will have a less elastic response than Sam. B) Sam will have a less elastic response than Linda. C) Sam and Linda will have identically elastic responses. D) Sam will have a more elastic response than Linda.

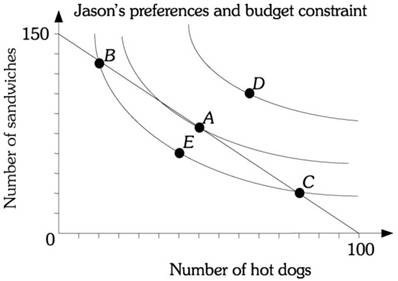

Refer to the information provided in Figure 6.15 below to answer the question that follows. Figure 6.15Refer to Figure 6.15. Why is Jason not maximizing his utility at point C?

Figure 6.15Refer to Figure 6.15. Why is Jason not maximizing his utility at point C?

A. He is not spending his entire budget. B. His marginal utility per dollar spent on the last sandwich is less than his marginal utility per dollar spent on his last hot dog. C. His marginal utility per dollar spent on the last sandwich is greater than his marginal utility per dollar spent on his last hot dog. D. He is maximizing his utility at point C.