Mike Miller is the town manager of Medfield, a town with 50,000 residents. At a recent town meeting, several citizens proposed building a large public swimming pool in the center of town for all of the residents to enjoy. A survey of all 50,000 residents revealed that the pool would be worth $50 to each of them. Because the cost to build the swimming pool is only $1,000,000 . Manager Miller

arranges to have the pool built. Everyone in town enjoys the pool, but when Manager Miller asks for donations to pay for the pool, he only collects $250,000 . Manager Miller soon realizes that

a. the survey was conducted improperly.

b. the cost of the pool exceeded the social benefits.

c. the pool is a club good.

d. most residents of the town are probably free-riders at the pool.

d

You might also like to view...

Price taking behavior exists in

A) perfectly competitive markets. B) markets with a monopolist, where consumers have to take price as it is given to them by the monopolist. C) automobile markets where consumers have to take the price set by the dealer. D) Both answers B and C are correct.

When economists describe the theory of consumer choice, they

a. portray people as simple and methodical with perfectly predictable patterns of behavior. b. assert that consumer's decisions are based on which goods and services give them the greatest utility within their limited incomes. c. point out that consumers rarely consider utility in their purchase decisions; they look at other factors like convenience, peer behavior, and price. d. assert that the retail price is the only variable consumers really consider in making their purchasing decisions. e. admit that consumer behavior is random and there is no credible economic theory to explain the phenomenon.

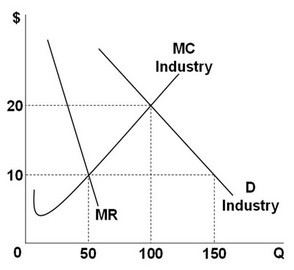

Based on the diagram above, what is the difference between the purely competitive level of output and the pure monopolist level of output?

Based on the diagram above, what is the difference between the purely competitive level of output and the pure monopolist level of output?

A. 50 units of output B. 100 units of output C. 10 units of output D. 20 units of output

The marginal tax rate is:

A. the difference between the total tax rate and the average tax rate. B. the percentage of total income paid as taxes. C. change in taxes/change in taxable income. D. total taxes/total taxable income.