What would happen to a low-income nation if its liability currency appreciated against its own currency?

A) Its external wealth would rise because low-income nations have more assets than liabilities.

B) Its external wealth would not be affected because currency values are fixed.

C) Its external wealth would fall because low-income nations tend to have more external liabilities denominated in other currencies.

D) Its external wealth would rise because of the ability of its monetary authority to print more money.

Ans: C) Its external wealth would fall because low-income nations tend to have more external liabilities denominated in other currencies.

You might also like to view...

When the trade-offs you face are determined by the choices someone else will make, behaving rationally involves:

A. behaving strategically. B. ignoring the behavior of other actors. C. acting in a way to help others. D. All of these statements are true.

Explain why marginal revenue is less than price for a monopolist.

What will be an ideal response?

Suppose that you can schedule a worker up to four hours per day. The benefit function is given by B(H) = 500H - 22.5H2 and the cost function is given by C(H) = 100 + 15H2. The corresponding marginal benefit and marginal cost functions are given by MB(H) = 500 - 45H and MC(H) = 100 + 30H. What is the best choice of hours for this worker?

What will be an ideal response?

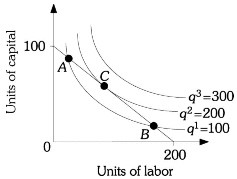

Refer to the information provided in Figure 7.10 below to answer the question(s) that follow.  Figure 7.10Refer to Figure 7.10. At Point C, the absolute value of the slope of q2 = 200 is

Figure 7.10Refer to Figure 7.10. At Point C, the absolute value of the slope of q2 = 200 is

A. less than 2. B. exactly equal to 2. C. greater than 2. D. indeterminate from this information.