Suppose you have two investments to choose from:

1, A one-year $20,000 zero coupon bond

2, A two-year $20,000 zero coupon bond

What is the difference between the prices of these bonds if the interest rate rises from 4% to 5%?

A) You would lose $167.39 more on the two year bond.

B) You would lose $167.39 more on the one year bond.

C) You would gain $350.54 more on the two year bond.

D) You would lose $183.15 more on the one year bond.

A

You might also like to view...

In a world of certainty about future demand and supply, speculators cause price fluctuations across time to decrease.

Answer the following statement true (T) or false (F)

In a duopoly with a collusive agreement and in a one-time only game, a firm's profit is largest if it ________ the agreement and if the other firm ________ the agreement

A) complies with; complies with B) complies with; cheats on C) cheats on; complies with D) cheats on; cheats on

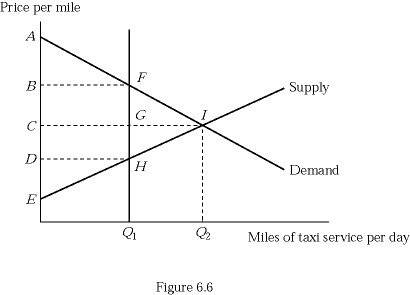

Refer to Figure 6.6, which shows a market for taxi medallions. If the number of taxi licenses is reduced from Q2 to Q1, the decrease in total surplus of the market is represented by:

Refer to Figure 6.6, which shows a market for taxi medallions. If the number of taxi licenses is reduced from Q2 to Q1, the decrease in total surplus of the market is represented by:

A. area FGI. B. area GHI. C. area FHI. D. area BDFH - area FHI.

For supply-side inflation to occur in the long run

A. the long-run aggregate supply curve has to shift to the left. B. the aggregate demand curve has to shift to the left. C. the long-run aggregate supply curve has to shift to the right. D. the aggregate demand curve has to shift to the right.