Consider the interaction between U.S. dollars and U.K. pounds. When the forward premium on the dollar is zero, it means

A. the current forward price of dollars equals the current spot price of dollars.

B. the current spot price of dollars equals the future spot price of dollars.

C. the future spot price of dollars will be equal to the current forward price of dollars.

D. the spot exchange rate value of the pound is moving toward $1 per pound.

Answer: A

You might also like to view...

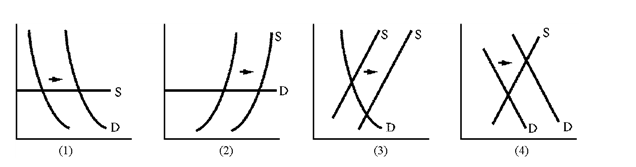

Figure 6-8

A. 1 B. 2 C. 3 D. 4

Which statement is true?

A. The poverty line is raised each year. B. The poverty line is lowered each year. C. The poverty line stays the same from one year to the next. D. None of these statements are true.

Which of these attempts at promoting energy conservation would shift the demand curve for energy to the left?

A. A higher average speed limit B. A reduction in the amount of available oil C. A higher tax on gasoline D. A tougher fuel efficiency standard for cars

In a perfectly competitive market, a firm in long-run equilibrium will be operating

A. at the minimum of the marginal cost curve. B. at the minimum of the long-run average cost curve. C. to the left of the minimum of the long-run average cost curve. D. to the right of the minimum of the long-run average cost curve.