For every $100 in assets, a bank has $40 in interest-rate sensitive assets, and the other $60 in non-interest-rate sensitive assets. The same bank has $50 for every $100 in liabilities in interest-rate sensitive liabilities, the other $50 are in liabilities that are not interest-rate sensitive. If the interest rate on assets increases from 5 to 6 percent, and the interest rate on liabilities increases from 3 to 4 percent, the impact on the bank's profits per $100 of assets will be:

A. a decrease of $0.10.

B. a reduction of $1.00.

C. an increase of $0.10.

D. zero since the interest rates on assets and liabilities increased by the same amount.

Answer: A

You might also like to view...

Which of the following would be considered a contingent contract?

A) a piece rate contract B) a profit-sharing contract C) a contact with a bonus D) All of the above.

Governments may intervene in private markets through

A) rationing by political power. B) price floors. C) price ceilings. D) all of the above.

Behavioral economists:

A. rely primarily on data drawn from the real world. B. typically assume that each individual has well-defined objectives, that there is a connection between an individual's objectives and actions and that the actions chosen affect an individual's well-being. C. avoid mathematical models of behavior, as they do not adequately describe real world actions. D. typically assume that each individual has well-defined objectives and avoid mathematical models of behavior, as they do not adequately describe real world actions.

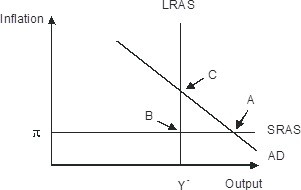

The economy pictured in the figure has a(n) ________ gap with a short-run equilibrium combination of inflation and output indicated by point ________.

A. recessionary; A B. recessionary; C C. recessionary; B D. expansionary; A