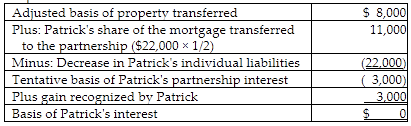

Patrick acquired a 50% interest in a partnership by contributing property that had an adjusted basis of $8,000 and a fair market value of $29,000. The property was subject to a liability of $22,000, which the partnership assumed for legitimate business purposes. Which of the following statements is correct?

A) Patrick will be required to recognize a $3,000 gain due to the negative basis rules and will have a basis in his partnership interest of zero.

B) Patrick will not be required to recognize a gain on his return and will have a basis in his partnership interest of negative $3,000.

C) Patrick will be required to recognize a $21,000 gain due to the negative basis rules and will have a basis in his partnership interest of zero.

D) Patrick will be required to recognize a $14,000 gain due to the negative basis rules and will have a basis in his partnership interest of zero.

A) Patrick will be required to recognize a $3,000 gain due to the negative basis rules and will have a basis in his partnership interest of zero.

You might also like to view...

Explain and give an example of the costs and rewards of relationships.

What will be an ideal response?

The owner of a seafood market determined that the average weight for a crab is 1.6 pounds with a standard deviation of 0.4 pound

Assuming the weights of the crabs are normally distributed, what is the probability that a randomly selected crab will weigh more than 2.2 pounds?

Why is the search for new profitable projects so important?

What will be an ideal response?

With preformatted screens a computer system asks the user for input or asks questions that the user must answer.

Answer the following statement true (T) or false (F)