On June 30, 2018, Temika purchased office furniture and fixtures (7-year property) costing $800,000 and technology equipment (5-year property) with a cost of $450,000. She uses Sec. 179, but she does not claim bonus depreciation. Her business income is $1,190,000 without considering Sec. 179. How should she allocate the Sec. 179 election in order to maximize her total cost recovery deductions

(depreciation and Sec. 179) for 2018?

What will be an ideal response?

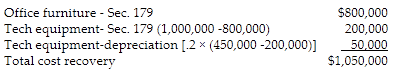

If Temika assigns the Sec. 179 deduction first to the office furniture, then to the computers:

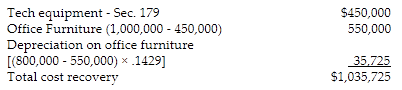

If Temika assigns the Sec. 179 deduction first to the technology equipment, then to the furniture:

Temika should allocate the Sec. 179 deduction first to the office furniture to maximize her cost recovery deductions.

You might also like to view...

Longer the maturity of a Treasury security, the smaller the interest rate risk

Indicate whether the statement is true or false

The six modes of social control are less important today due to the globalization of the world.

Answer the following statement true (T) or false (F)

Five years ago, George and Jerry (his brother) provide $40,000 and $60,000, respectively, to purchase realty titled in the names of George and Jerry as joint tenants with right of survivorship. George dies in the current year and is survived by Jerry. At the time of George's death, the realty is valued at $300,000. What is the value of the realty in George's gross estate?

What will be an ideal response?

After World War I, organizations shifted their attention away from scientific management to understanding the role of __________ .

A. managerial corruption B. law and politics C. gender and sexual harassment D. religion and spirituality E. human factors and psychology