Assume the price of capital doubles and, as a result, firms make no change in the relative quantities of capital and labor they employ. This implies that:

A. labor is not readily substitutable for capital.

B. the law of diminishing returns is not applicable.

C. the firms are producing an inferior good.

D. the demand for capital is highly price elastic.

Answer: A

You might also like to view...

The tax treatment of corporate profit means that corporations

A. cannot profitably issue common stock. B. choose investment opportunities more efficiently than do other types of firms. C. limit the things in which corporations can invest. D. can generally avoid paying federal taxes but not state taxes.

An IRA (Individual Retirement Account) allows taxpayers to invest money out of their personal income before taxes

Financial advisors will often tell their clients that they will realize more net pay (income after taxes) if they invest with an IRA versus saving their money in a simple savings account at a bank. Explain how this is so.

If you buy an insurance policy with a high deductible and co-payments, you would end up paying

a. A higher premium b. A lower premium c. The premium of a low risk individual d. Both B&C

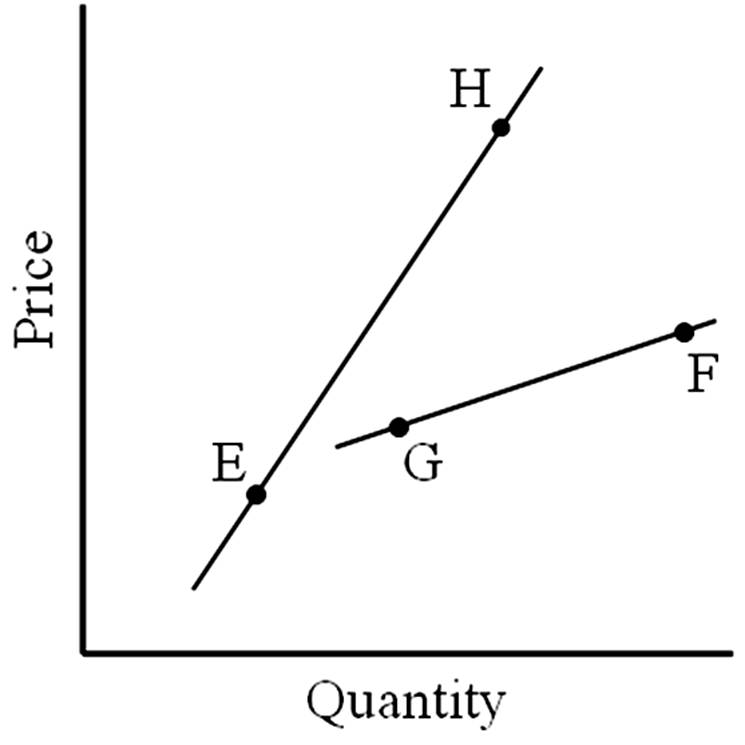

A move from E to F represents

A. a change in quantity supplied.

B. no change in supply.

C. an increase in supply.

D. a decrease in supply.