Suppose you borrow $2,000 for one year and at the end of the year you repay the $2,000 plus $110 of interest. If the expected inflation rate was 2.2% at the time you took out the loan, what was the real interest rate you paid?

A) 2.2%

B) 3.3%

C) 5.5%

D) 7.7%

B

You might also like to view...

If we know that the slope of the consumption function is 0.6, then we know that if real disposable income increased by $1,000 billion, real consumption spending would

a. increase by $60 billion b. increase by $1,000 billion c. increase by $600 billion d. increase by $6,000 billion e. decrease by $6 billion

According to the Phillips curve, a more expansionary macro-policy that causes inflation to be greater will:

A. place downward pressure on prices. B. reduce unemployment. C. reduce output. D. reduce the natural rate of unemployment.

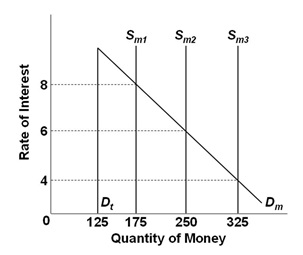

Refer to the graph , in which Dt is the transactions demand for money, Dm is the total demand for money, and Sm is the supply of money. The market is initially in equilibrium at a 6 percent interest rate. If the money supply increases, then Sm2 will shift to:

A. Sm3 and the interest rate will be 4 percent

B. Sm3 and the interest rate will be 8 percent

C. Sm1 and the interest rate will be 8 percent

D. Sm1 and the interest rate will be 4 percent

The potential for moral hazard exists in most corporations because the managers or officers ofthe corporation are often not the owners; this is called the principal-agent problem. The managers may not always act in the best interest of the owners. For example, the owners may prefer a higher return that calls for a greater risk to be taken. The managers (preferring to keeptheir jobs) may shun the additional risk, preferring the job security over a higher return for theowners. The threat that the company can be and likely may be purchased by others if it is under performing can actually motivate the managers to seek a higher return.

Indicate whether the statement is true or false. a. True b. False