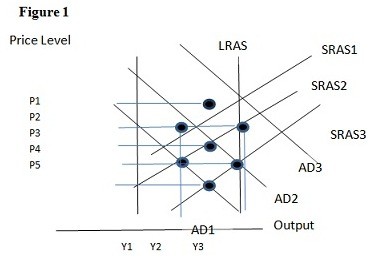

Using Figure 1 above, if the aggregate demand curve shifts from AD3 to AD2 the result in the short run would be:

A. P3 and Y1.

B. P2 and Y1.

C. P2 and Y3.

D. P1 and Y2.

Answer: B

You might also like to view...

Ann Trepreneur was formerly a landlord, renting her building for $1,200 a month. She now uses her building for her own florist shop. Pick the true statement

A) The building costs Ann $1,200 per month. B) Ann incurs no opportunity cost on the building. C) Ann uses the building as a free good. D) None of the above is true.

Monetarists argue that the interest elasticity of the demand for money is

a. low, while Keynesians say it is high. b. important in terms of affecting economic activity. c. highly variable. d. an important factor in determining if velocity is stable or unstable.

A bank's assets consist of $1,000,000 in total reserves, $2,100,000 in loans, and a building worth $1,200,000 . Its liabilities and capital consist of $3,000,000 in demand deposits and $1,300,000 in capital. If the required reserve ratio is 20 percent, what is the level of the bank's excess reserves? How much money could the excess reserves be used to create in the banking system as a result?

a. $600,000; $600,000 b. $600,000; $3,000,000 c. $400,000; $400,000 d. $400,000; $2,000,000

In the best case scenario, what is the Fed's response to a negative demand shock?

A. The Fed will decrease the growth rate of the money supply to offset the negative demand shock. B. The Fed will increase the growth rate of the money supply to offset the negative demand shock. C. The Fed will increase government spending to offset the negative demand shock. D. The Fed will decrease government spending to offset the negative demand shock.