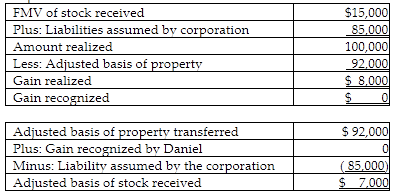

Daniel transfers land with a $92,000 adjusted basis and a $100,000 FMV to a corporation in a Sec. 351 transfer. Immediately after the transfer, Daniel owns 100% of the corporation-stock with a FMV of $15,000. In addition, $85,000 of business-related liabilities are assumed by the corporation with respect to the transfer. No other property is transferred. Daniel's basis in the stock is

A) $0.

B) $7,000.

C) $8,000.

D) $100,000.

B) $7,000.

Business

You might also like to view...

When exchanging equipment, if the trade-in allowance is greater than the book value a loss results

Indicate whether the statement is true or false

Business

How do mentoring and cross-training mitigate risk?

What will be an ideal response?

Business

When selecting contractors or suppliers, information gathering documents include

A) RFIs. B) RFQs. C) RFPs. D) all of the above.

Business

The Bay City Planning Department, the Coastal County Zoning Commission, the Delaware Environmental Quality Agency, and the U.S. Bureau of Land Management issue regulations.These rules constitute

a. administrative law. b. case law. c. stare decisis. d. statutory law.

Business