Voorhees Manufacturing Corporation produces three products in a joint process. Additional information is as follows:ProductO P Q Total Units produced 42,000 50,000 8,000 100,000 Sales value at split off$250,000 $50,000 $20,000 $320,000 Additional costs if processed further$18,000 $30,000 $10,000 $58,000 Sales value if processed further$290,000 $70,000 $25,000 $385,000 Joint costs $300,000 Product weights in pounds 84,000 150,000 8,000 242,000 Required:(a) Determine which products should be sold at split-off and which should be processed further.(b) Assuming Voorhees makes decisions that are in its best interest for overall profitability, what would be the company's gross margin?

What will be an ideal response?

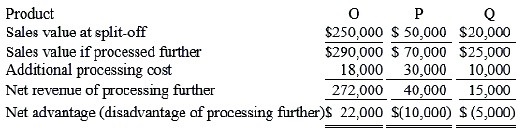

(a) Only Product O should be processed further. It is the only product where the incremental processing costs are less than the incremental revenues.

(b) If Voorhees processes Product O further and sells Product P and Product Q at split-off, its gross margin will be $42,000.

| Sales ($290,000 + $50,000 + $20,000)$360,000 |

| Additional processing costs 18,000 |

| Joint costs 300,000 |

| Gross margin$42,000 |

You might also like to view...

Co-branding is when two or more well-known existing brands are combined into a joint product and/or marketed together in some fashion

Indicate whether the statement is true or false

The value chain is also called the supply network

Indicate whether the statement is true or false

Police power permits states and local governments to enact laws to protect or promote the public health, safety, morals, and general welfare

Indicate whether the statement is true or false

Pluto Hand Blenders Company sold 3,000 units in October at a sales price of $45 per unit. The variable cost is $25 per unit. Calculate the total contribution margin

A) $135,000 B) $60,000 C) $75,000 D) $37,500