Which of the following procedures would normally be performed by the auditor when conducting tests of payroll transactions?

A. Interview employees selected in a statistical sample of payroll transactions.

B. Trace a sample of payroll checks to the master employee list.

C. Examine signatures on paid salary checks.

D. Confirm amounts withheld from employees' salaries with proper governmental authorities.

Answer: B

You might also like to view...

The acronym for the six- step listening process, stands for ______.

a. hearing, understanding, responding, investigating, evaluating, and remembering b. hearing, understanding, remembering, interpreting, evaluating, and responding c. hearing, understanding, responding, interpreting, evaluating, and remembering d. hearing, understanding, remembering, investigating, examining, and responding

In a decision dealing with adding or dropping a product, the product should be dropped when the ________ exceed the contribution margin that is lost

a. losses incurred b. profits c. variable costs d. avoided fixed costs

Chester perceives his career to be a calling so he is likely to think that he will be successful even if he does not invest full effort into his work

Indicate whether the statement is true or false.

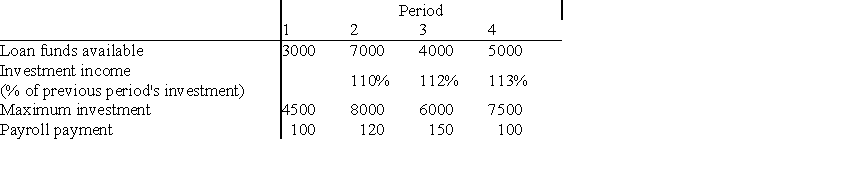

In each period, funds available for investment come from two sources: loan funds and income from the previous period's investment. Expenses, or cash outflows, in each period must include repayment of the previous period's loan plus 8.5% interest, and the current payroll payment. In addition, to end the planning horizon, investment income from period 4 (at 110% of the investment) must be sufficient to cover the loan plus interest from period 4. The difference in these two quantities represents net income and is to be maximized. How much should be borrowed, and how much should be invested each period?

Information on a prospective investment for Wells Financial Services is given below.