The income effect associated with an income tax occurs because the individual has to work more to make up for the income paid in taxation

a. True b. False

a

You might also like to view...

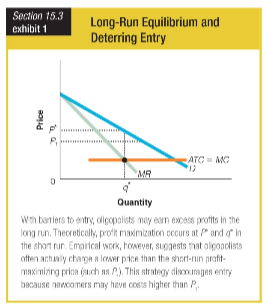

Theoretically, profit maximization occurs at P* and q* in the short run. However, empirical work suggests that oligopolists often actually charge P1. What would be the motivation for this action?

a. to increase P 1 above the profit maximization price over the short run

b. to reduce the entry initiative for new firms attracted by long-run economic profit

c. to increase the profit maximization price over the short run

d. to reduce the entry initiative for new firms attracted by zero long-run economic profit

The free-rider dilemma is associated with:

A.) Private goods. B.) Public goods. C.) Externalities. D.) Market power.

The process by which new firms and new products replace existing dominant firms and products is called:

A. monopolistic competition. B. the inverted-U process. C. process innovation. D. creative destruction.

If the property rights for forests are clear and enforced, then:

A. They will become common property B. Governments will not be able to overtax them C. Owners have profit incentives to harvest slowly over time D. The logging of the forest will increase at an unsustainable rate