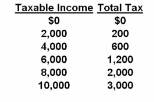

Refer to the table. This tax is such that the after-tax distribution of income will be:

A. more equal than the before-tax distribution.

B. less equal than the before-tax distribution.

C. distributed in precisely the same way as the before-tax distribution.

D. less than the before-tax distribution by the same percentage at each income level.

A. more equal than the before-tax distribution.

You might also like to view...

A firm produces an output level at which price is greater than marginal cost. Explain why this is inefficient

What will be an ideal response?

A common mistake made by consumers is the failure to take into account the monetary costs of their actions

Indicate whether the statement is true or false

The law of demand states that

A. the price can never be too high for some consumers. B. a higher price will lead to increased sales. C. consumers with more income will spend more on goods and services. D. quantity demanded of a good will vary inversely with the price of that good.

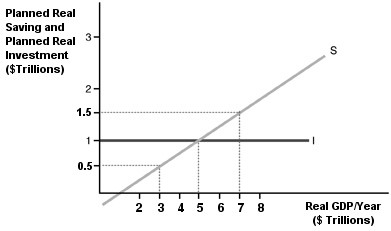

In the above diagram, what happens if the real GDP is $3 trillion? $5 trillion? $7 trillion? What is the equilibrium level of real GDP? Why?

In the above diagram, what happens if the real GDP is $3 trillion? $5 trillion? $7 trillion? What is the equilibrium level of real GDP? Why?

What will be an ideal response?