The Sarbanes-Oxley Act of 2002

A) requires that CEO's personally certify the accuracy of financial statements.

B) mandates that firms raise funds for expansion only through the sale of stock or from bank loans, but not from the sale of corporate bonds.

C) created the Consumer Financial Protection Bureau to be housed in the Federal Reserve.

D) established the Financial Stability Oversight Council to identify risks to the financial system.

A

You might also like to view...

Which of the following would increase aggregate supply?

A) increased training and education B) a reduction in input prices C) a discovery of new raw materials D) all of the above

When the Fed wishes to reduce the economy's money supply, it:

a. lowers the discount rate. b. lowers the required reserve ratio. c. reduces the margin requirement. d. sells some of its government securities. e. prints more money.

The addition to total costs associated with the production of one more unit of output is referred to as

A) average cost. B) marginal cost. C) opportunity cost. D) overhead cost.

Diseconomies of scale start between:

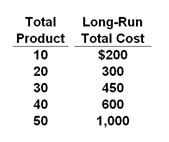

The following schedule gives the cost data for a firm:

A. 0 and 10 units of output

B. 40 and 50 units of output

C. 20 and 30 units of output

D. 30 and 40 units of output