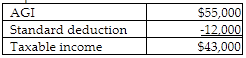

Tarik, a single taxpayer, has AGI of $55,000 which includes $1,000 of qualified dividends. Tarik does not of itemize deductions. What is his 2018 federal income tax?

A) $5,400

B) $5,330

C) $5,550

D) None of the above.

B) $5,330

The calculation of the tax is split between the tax on the qualifying dividends and the balance of the taxable income. The tax on the dividend income of $1,000 is $150 ($1,000 × .15). The tax on the $42,000 balance of taxable income is .22($42,000 - 38,700) + $4,453.50 = $5,180 rounded. The total tax liability is $5,180 + 150 = $5,330.

You might also like to view...

The actual and potential rival offerings and substitutes that a buyer might consider are referred to as the ________

A) supply chain B) global market C) value proposition D) competition E) marketing environment

The interest portion of an installment note payment is computed by multiplying the interest rate by the carrying amount of the note at the end of the period

Indicate whether the statement is true or false

Contracts for the provision of services are not covered by Article 2 of the UCC

Indicate whether the statement is true or false

According to the textbook, the true power of a manager is related to his/her

a. Academic intelligence b. Blood type c. Social intelligence d. Emotional intelligence