Consider the following statements when answering this question;

I. The variance of the returns of an investor's portfolio can be reduced by selling assets from the portfolio, and investing the proceeds in other assets where returns are positively correlated with the portfolio's remaining assets.

II. The value of complete information is always positive.

A) I and II are true.

B) I is true, and II is false.

C) I is false, and II is true.

D) I and II are false.

D

You might also like to view...

The ability of one person or nation to produce a good at a lower absolute cost than another is called a(n)

A) comparative advantage. B) specialization advantage. C) market advantage. D) absolute advantage.

Assuming that the average duration of its assets is four years, while the average duration of its liabilities is three years, then a 5 percentage point increase in interest rates will cause the net worth of First National to ________ by ________ of

the total original asset value. A) decline; 5 percent B) decline; 10 percent C) decline; 15 percent D) increase; 20 percent

You currently subscribe to two magazines and are trying to decide whether you should subscribe to a third. What should determine your decision, if you are rational?

a. the total cost of the magazines compared to the total satisfaction you would receive b. the total amount of satisfaction you would get from the magazines c. the enjoyment you would get from the third magazine d. the cost of the third magazine, including the time it takes to read it e. the cost of the third magazine compared to the additional enjoyment you would get from it

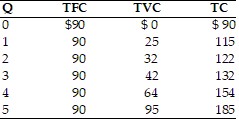

Refer to the above table. When output rises from 2 units to 5 units, marginal costs are

Refer to the above table. When output rises from 2 units to 5 units, marginal costs are

A. $26.50. B. $31. C. $63. D. $21.