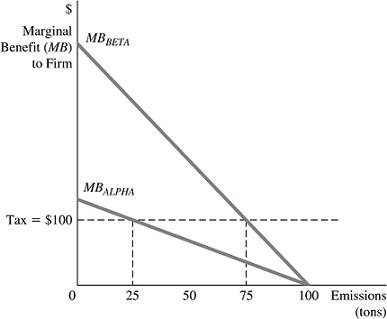

Refer to the information in Figure 16.5 below to answer the question(s) that follow. ?Figure 16.5Figure 16.5 shows the marginal benefits of emitting pollution for the only two chemical companies in an industry, Alpha Chemicals and Beta Chemicals. Before any tax on pollution emissions is imposed, each company views pollution as being free.Refer to Figure 16.5. The government decides to impose a tax on pollution emissions to cut total emissions in this industry in half, and based on this decision it has set the tax at $100 per ton of emissions. Following the implementation of this tax, the total amount of emissions reduction in this industry will be

?Figure 16.5Figure 16.5 shows the marginal benefits of emitting pollution for the only two chemical companies in an industry, Alpha Chemicals and Beta Chemicals. Before any tax on pollution emissions is imposed, each company views pollution as being free.Refer to Figure 16.5. The government decides to impose a tax on pollution emissions to cut total emissions in this industry in half, and based on this decision it has set the tax at $100 per ton of emissions. Following the implementation of this tax, the total amount of emissions reduction in this industry will be

________ tons.

A. 25

B. 50

C. 75

D. 100

Answer: D

You might also like to view...

The Federal Reserve pursued an expansionary monetary policy during 1964 in order to

A) pull the United States out of a deep recession. B) counteract the effects of a deep cut in federal income taxes. C) keep interest rates from rising. D) bring down the inflation rate.

Which of the following is an example of someone with inflationary expectations taking a step designed to insulate themselves from the higher expected rates of inflation?

a. a consumer deciding to delay the purchase of a new home or automobile b. a consumer who borrows money at a fixed interest rate in order to purchase a new home or automobile c. an investor who borrows funds at an adjustable money interest rate (one that automatically increases with higher inflation) d. a home buyer who borrows funds at a variable interest rate

Medicaid is

a. the government's health plan for the elderly. b. the government's health plan for the poor. c. another name for Social Security. d. Both a and c are correct.

You are given the following information about aggregate demand at the existing price level for an economy: (1) consumption = $400 billion; (2) investment = $40 billion; (3) government purchases = $90 billion; and (4) net export = $25 billion. If the full-employment level of GDP for this economy is $600 billion, then what combination of actions would be most consistent with closing the GDP-gap here?

A. Increase government spending and taxes B. Decrease government spending and taxes C. Decrease government spending and increase taxes D. Increase government spending and decrease taxes