A change in tax rates

A) has a less complicated effect on GDP than does a tax cut of a fixed amount.

B) has a larger multiplier effect the smaller the tax rate.

C) will not affect disposable income.

D) will not affect the size of the multiplier.

Answer: B

You might also like to view...

Real GDP fluctuates from year to year but is always below potential GDP

Indicate whether the statement is true or false

If a government enacts a price floor on agricultural products to protect wheat farmers, the result is likely going to be

a. an increase in price with a surplus of wheat. b. an increase in price with a shortage of wheat. c. a decrease in price with a surplus of wheat. d. a decrease in price with a shortage of wheat.

Freely functioning markets in the real world always result in efficient allocations of resources.

Answer the following statement true (T) or false (F)

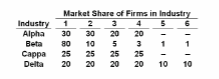

Refer to the table. A merger between Firm 1 in Alpha and Firm 2 in Delta would be a:

Answer the question on the basis of the following table showing market shares of firms in hypothetical industries. Assume these are distinct industries with no buyer-seller relationships or competition among them.

A. vertical merger.

B. horizontal merger.

C. conglomerate merger.

D. diagonal merger.