The following is taken from Clausen Company's internal records of its factory with two operating departments. The cost driver for indirect labor is direct labor hours, and the cost driver for the remaining items is number of hours of machine use. Compute the total amount of overhead allocated to Dept. 2 using activity-based costing. Direct Labor Hours Machine Hours Operating Dept. 1 980 9,200 Operating Dept. 2 2,100 6,000 Totals 3,080 15,200 Factory overhead costs Rent and utilities $21,700 Indirect labor 17,300 Depreciation - Equipment 14,000 Total factory overhead $53,000

A. $11,795.

B. $27,112.

C. $26,500.

D. $25,887.

E. $14,092.

Answer: D

You might also like to view...

Conversion to new computer programs must be undertaken using contingency plans to ensure that only authorized, tested, and approved versions of the programs are promoted to production status

Indicate whether the statement is true or false

Spontaneity refers to a genuine, natural way of communicating with

A) manipulation and tricks B) judging and blaming C) detached and impersonal tone D) honesty and openness

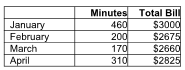

What is the variable cost per minute? (Round your answer to the nearest cent.)

The phone bill for a company consists of both fixed and variable costs. Refer to the four-month data

below and apply the high-low method to answer the question.

A) $1.17

B) $6.52

C) $0.85

D) $0.11

Using only data and information to make decisions and solve problems is the key to finding success in business. These are also the only core drivers of the information age and the building blocks of business systems.

Answer the following statement true (T) or false (F)