Two investments have the following expected returns (net present values) and standard deviations: PROJECT Expected Value Standard Deviation Q $100,000 $20,000 X $50,000 $16,000 Based on the Coefficient of Variation, where the C.V. is the standard deviation dividend by the expected value

a. All coefficients of variation are always the same.

b. Project Q is riskier than Project X

c. Project X is riskier than Project Q

d. Both projects have the same relative risk profile

e. There is not enough information to find the coefficient of variation.

c

You might also like to view...

Without scarcity, people would not have to

a. share b. collaborate c. disagree d. choose e. settle

Deficit is to debt as

a. responsible is to irresponsible. b. increase is to decrease. c. flow is to stock. d. important is to unimportant.

Which of the following government programs provides recipients with unrestricted cash payments?

a. The food stamp program b. Medicaid c. Temporary Assistance to Needy Families (TANF) d. Housing assistance programs

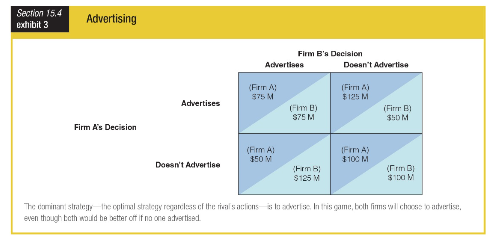

What is the final outcome if each firm follows its dominant strategy?

a. Each firm makes a profit of $75 M.

b. Each firm makes a profit of $100 M.

c. Each firm makes a profit of $125 M.

d. Each firm makes a profit of $175 M.