Taxes:

A. may benefit many of the consumers in the market.

B. are sometimes used to correct market failures.

C. are sometimes used to transfer surplus from producers to consumers.

D. are sometimes used to transfer surplus from consumers to producers.

B. are sometimes used to correct market failures.

You might also like to view...

The price of a bag of pretzels rises from $2 to $3 and the quantity demanded decreases from 100 to 60. What is the price elasticity of demand?

A) 1.0 B) 1.25 C) 40.0 D) 20.0 E) 0.80

What can be said about the demand and supply of natural resources?

a. The quantity demanded of a natural resource will generally be less responsive to a change in price in the long run than in the short run. b. The supply of a natural resource will generally be more responsive to a price change in the long run than in the short run. c. The supply of a natural resource is fixed by nature; it cannot be responsive to a price change in the long run. d. None of the above is correct.

Which of the following is correct?

a. Once adjustment is made for inflation, the prices of most natural resources have been about steady or falling. b. Technological progress has allowed us to substitute renewable resources for some nonrenewable resources. c. Technological progress has made once-crucial natural resources less necessary. d. All of the above are correct.

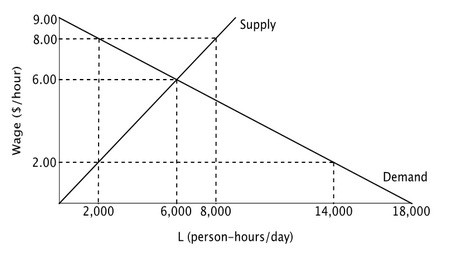

Consider the accompanying figure representing the labor market below. Suppose the government passes a minimum wage requiring employers to pay at least $8.00 per hour. Prior to the imposition of the minimum wage, worker surplus is ________ per day, and after the imposition of the minimum wage, worker surplus is ________ per day.

Prior to the imposition of the minimum wage, worker surplus is ________ per day, and after the imposition of the minimum wage, worker surplus is ________ per day.

A. $9,000; $5,000 B. $18,000; $2,000 C. $18,000; $14,000 D. $9,000; $1,000