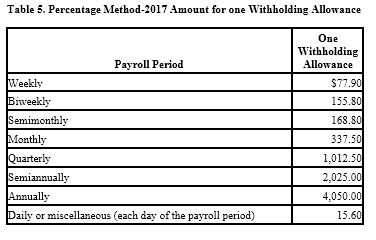

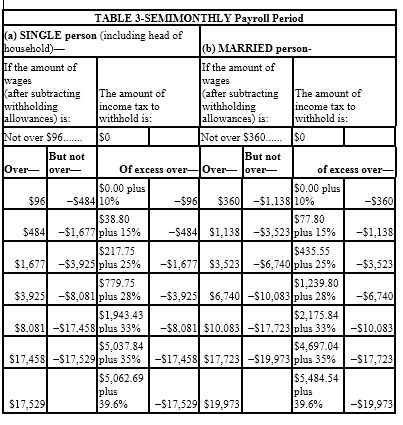

Danny is a full-time exempt employee in Alabama, where the state income tax rate is 5%. He earns $78,650 annually and is paid semimonthly. He is married with four withholding allowances. His is health insurance is $100.00 per pay period and is deducted on a pre-tax basis. Danny contributes 5% of his pay to his 401(k). Assuming that he has no other deductions, what is Danny's net pay for the

period? (Use the percentage method for the federal income tax and the wage-bracket table for the state income tax. Do not round interim calculations, only round final answer to two decimal points.)

A) $2,245.53

B) $2,403.95

C) $2,361.72

D) $2,178.90

C) $2,361.72

You might also like to view...

______________________________ expect convenient and timely access to information about their order from order initiation, through product delivery, and until after the bill had been paid

Fill in the blank(s) with correct word

Rust Industries purchased a wood pulp mixer for $30,000. Using the MACRS method, calculate the book value at the end of year 3. (Round all dollar amounts to the nearest cent)

A. $13,119.00 B. $5,247.00 C. $9,372.00 D. $3,747.00

In most contracts, promises of performance are not expressly conditioned

a. True b. False Indicate whether the statement is true or false

Which of the following constitutes constructive receipt in 2018?a.A check received on December 29, 2018. The check was postdated January 5, 2019.b.A check received on January 4, 2019. It had been mailed on December 29, 2018.c.A rent check, received on December 31, 2018, by the manager of an apartment complex. The manager normally collects rent for the owner who is out of town.d.A salary check received at 5:30 p.m. on December 31, 2018, after all banks are closed.e.A paycheck received on December 26, 2018. The check was not honored by the bank because the employer's account did not have sufficient funds.

What will be an ideal response?