Refer to Table 20.2. Is the tax system represented in the table progressive, regressive, or neither one? How can you tell?

What will be an ideal response?

The tax system is regressive.

When income is $20,000, the tax payment is $2,000, so the tax rate is 10%.

When income is $25,000, the tax payment is $2,250, so the tax rate is 9%.

When income is $30,000, the tax payment is $2,400, so the tax rate is 8%.

When income is $35,000, the tax payment is $2,450, so the tax rate is 7%.

As income increases, the tax rate decreases, which means the tax is regressive.

You might also like to view...

The price of a firm's product is $8 and the firm faces a constant marginal cost of $5 that is equal to its (constant) average total cost. If the firm does not sell a unit of its product on the day it was produced, it is sold in a secondary market for a price of $2. If the firm does not sell a unit of its product on the day it was produced, there is a ________ of ________ per unit not sold.

A) loss; $3 B) profit; $3 C) profit; $5 D) loss; $2

For most goods and most people, marginal utility probably

a. continues to increase as larger quantities are purchased. b. plummets after the first few units but soon begins to rise. c. declines as consumption increases. d. is negative after the first unit of a good is purchased. e. is positive and rising for most goods.

Aggregate demand is the total demand for

a. all intermediate and final goods. b. all monetary investments. c. real and financial investments. d. all final goods and services.

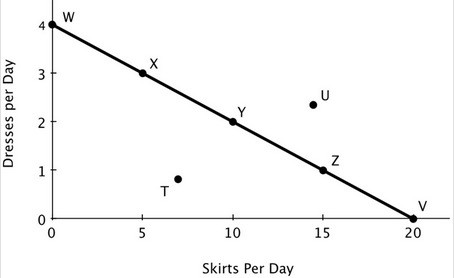

The accompanying figure shows Becky's daily production possibilities curve for dresses and skirts. Relative to point X, at point Y:

Relative to point X, at point Y:

A. fewer skirts and fewer dresses are produced. B. more dresses and fewer skirts are produced. C. more dresses and more skirts are produced. D. more skirts and fewer dresses are produced.