Grace Company sold equipment for $40,000 cash. The equipment has cost $70,000 and had accumulated depreciation of $44,000 at the time of the sale. Based on this information alone, which of the following statements is true?

A. Cash flow from investing activities would be the same regardless of whether the sale of equipment is reported on the statement of cash flows under the direct method or the indirect method.

B. Cash flow from investing activities would be less if the sale of equipment is reported on the statement of cash flows under the direct method than if it is reported under the indirect method.

C. Cash flow from investing activities would be greater if the sale of equipment is reported on the statement of cash flows under the direct method than if it is reported under the indirect method.

D. The answer cannot be determined because the amount of the salvage value is unknown.

Answer: A

You might also like to view...

Private International Law is the body of law that applies to interpretations of and disputes arising from commercial transactions between companies of different nations

Indicate whether the statement is true or false

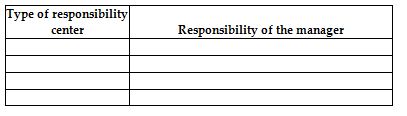

List the four types of responsibility centers. For each center, state the responsibility of the manager.

A credit card that carries the name of a sponsoring organization is called a(n)

A) affinity card. B) copyrighted card. C) trademark card. D) marketing card.

A supplier indicates that he will not be able to produce a product at the quality requested. This is an example of what type of project risk?

a. External b. Cost c. Schedule d. Operational