Which of the following observations is true?

A. Tax changes have no impact on the consumption schedule.

B. Tax reduction shifts the consumption schedule upward.

C. Changes in taxes have a multiplier effect on equilibrium GDP on the supply-side.

D. Tax increases increase equilibrium GDP.

Answer: B

You might also like to view...

If the U.S. interest rate rises while interest rates in the rest of the world do not change, the higher U.S. interest rate

A) decreases the demand for dollars. B) increases the demand for dollars. C) has no effect on the demand for dollars. D) will stop all trading between the currencies of the U.S. and other countries.

In Table 1, pizzas are classified as a(n)

A) normal good. B) positive good. C) inferior goods. D) marginal good.

Demand curves often do not remain stationary; they shift because of changes in other variables

a. True b. False Indicate whether the statement is true or false

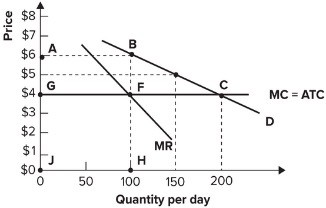

Refer to the graph shown. If a competitive industry producing hamburgers is taken over by a pure monopoly firm that maximizes profit:

A. price will remain at $4 but output will fall by 100. B. price will rise to $6 and output will fall by 100. C. price will remain at $6 but output will fall by 100. D. output will remain at 100 but price will rise to $6.