Discretionary fiscal policy involves

a. expansion of government revenues during a period of rapid growth.

b. contraction of government revenues during a recession.

c. automatic adjustments that affect the size of the budget deficit or surplus.

d. an intentional change in taxation or government spending.

e. both a and b.

D

You might also like to view...

If Congress passed a one-time tax cut in order to stimulate the economy in 2014, and tax rate levels returned to their pre-2014 level in 2015, how should this tax cut affect the economy?

A) The tax cut would increase consumption spending more than would a permanent tax cut. B) The tax cut would lower the price level in 2014. C) The tax cut would increase consumption spending by the same amount as would a permanent tax cut. D) The tax cut would increase consumption spending less than would a permanent tax cut.

A monopoly's goal using price discrimination is to increase

A) total revenue. B) marginal revenue. C) total profit. D) the per unit profit.

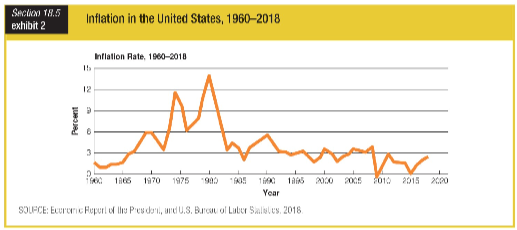

Which of the following periods is characterized by the sharpest increase in inflation?

a. 1968–1972

b. 1976–1980

c. 1980–1984

d. 2008–2012

Recall the Application the Joint Committee on Taxation and how Congress accounts for the dynamic effects of its policies to answer the following questions.The results highlighted in this Application shows that President Trump's tax cuts resulted in:

A. a decrease in tax revenue. B. an increase in tax revenue. C. no change in tax revenue. D. an increase in tax revenues early on, before tax revenues decreased in the long run.