The corporate income tax is

a. a tax on corporate profit, not revenue.

b. the single largest source of federal revenue.

c. a payroll tax paid partially by employees and partially by employers.

d. has increased as a proportion of federal tax revenue since 1950.

a

You might also like to view...

When there is an expansionary gap, inflation will ________, in response to which the Federal Reserve will ________ real interest rates, and output will ________.

A. decline; lower; expand B. increase; raise; decline C. decline; lower; decline D. decline; raise; decline

A shift of the supply curve of oil raises the price from $60 a barrel to $75 a barrel and reduces the quantity demanded from 40 million to 20 million barrels a day. You can conclude that the

A) demand for oil is elastic. B) demand for oil is inelastic. C) supply of oil is elastic. D) supply of oil is inelastic.

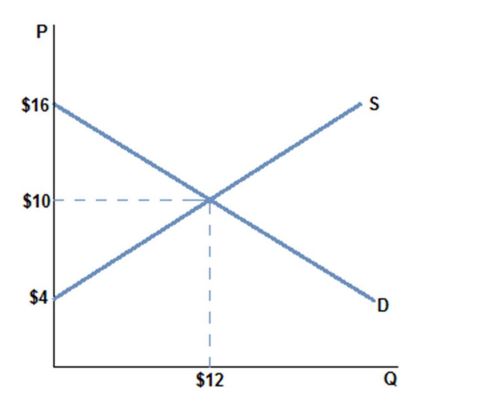

According to the graph shown:

A. consumer surplus is greater than producer surplus.

B. producer surplus is greater than consumer surplus.

C. total surplus is smaller than consumer surplus.

D. total surplus is smaller than producer surplus.

Holding other things constant, if the Japanese Yen, appreciates, it makes the imports to Japan

a. More expensive for Japanese customer b. Less expensive for Japanese customers c. Neither more or less expensive for importers d. None of the above