How will the exchange rate (foreign currency per dollar) respond to an increase in the relative rate of productivity growth in the United States in the long run?

A) Exchange rates will rise.

B) Exchange rates will be unaffected by changes in the relative rate of productivity growth in the United States, both in the short run and in the long run.

C) The exchange rate will be affected in the short run, but not in the long run.

D) Exchange rates will fall.

A

You might also like to view...

Refer to the above table. Assuming constant opportunity costs, which of the of the following statements is correct if the rate of exchange is 1 movie for 1 cuckoo clock

A) U.S. residents would be willing to export cuckoo clocks, but Swiss residents would not gain from exporting movies at this rate of exchange. B) Swiss residents would be willing to export movies, but U.S. residents would not gain from exporting cuckoo clocks at this rate of exchange. C) U.S. residents will gain from exporting movies and Swiss residents will gain from exporting cuckoo clocks at a rate of exchange. D) U.S. residents will gain from exporting cuckoo clocks and Swiss residents will gain from exporting movies at a rate of exchange.

Reinsurance is a common solution for insurance companies when the

A. uncertainty to homeowners and insurance companies is large. B. uncertainty cannot be summarized actuarially. C. uncertainty to homeowners is large but small for insurance companies. D. uncertainty to homeowners and insurance companies is small.

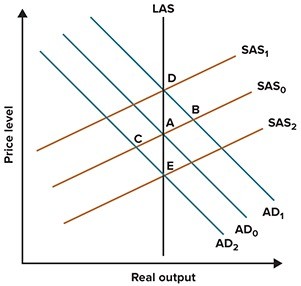

Refer to the graph shown. Monetary policy that shifts the AD curve from AD0 to AD1 and moves the economy from A to B:

A. increases both real and nominal output in the short run. B. increases real output but not nominal output in the short run. C. doesn't increase real or nominal output in the short run. D. increases nominal output but not real output in the short run.

Considering the balance sheet for all commercial banks in the U.S., the net worth of banks is:

A. about the same as total liabilities. B. just about the same as total assets. C. about 5 times the total assets. D. about 1/11 of total assets.