At any point above the current LM curve, there is an

A) excess demand for money.

B) excess supply of money.

C) excess demand for goods.

D) excess supply of goods.

B

You might also like to view...

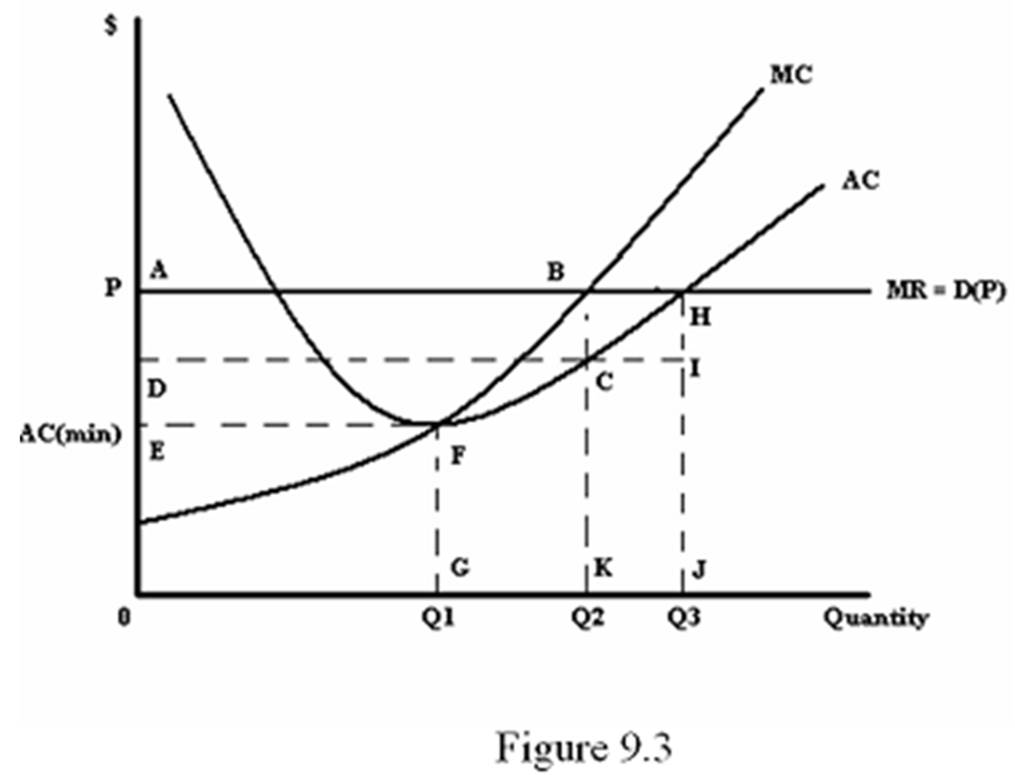

Refer to Figure 9.3. What is the smallest sales quantity that this firm will produce at any price?

A. 0

B. Q1

C. Q2

D. Q3

Disposable income is obtained by

a. subtracting personal income taxes from personal income. b. subtracting personal income taxes from national income. c. adding transfer payments to national income. d. adding transfer payments to personal income.

Which of the following is a progressive tax?

A. The Social Security tax. B. The federal income tax. C. Local property taxes. D. Local sales taxes.

When a good is taxed, the burden of the tax

a. falls more heavily on the side of the market that is more elastic. b. falls more heavily on the side of the market that is more inelastic. c. falls more heavily on the side of the market that is closer to unit elastic. d. is distributed independently of relative elasticities of supply and demand.