The crowding-out effect suggests that:

A. tax increases are paid primarily out of saving and therefore are not an effective fiscal

device.

B. government borrowing to finance the public debt increases the real interest rate and reduces private investment.

C. it is very difficult to have excessive aggregate spending in a capitalist economy.

D. consumer and investment spending always vary inversely.

B. government borrowing to finance the public debt increases the real interest rate and reduces private investment.

You might also like to view...

As disposable income increases, consumption

A. decreases. B. may either increase or decrease depending on the MPC. C. increases. D. may either increase or decrease depending on the wealth effect.

The view that expectations change relatively slowly over time in response to new information is known in economics as

A) rational expectations. B) irrational expectations. C) slow-response expectations. D) adaptive expectations.

Which of the following is a contractionary fiscal policy that decreases the level of aggregate demand?

a. reduced business taxes b. reduced government spending c. reduced payroll taxes d. reduced personal income taxes

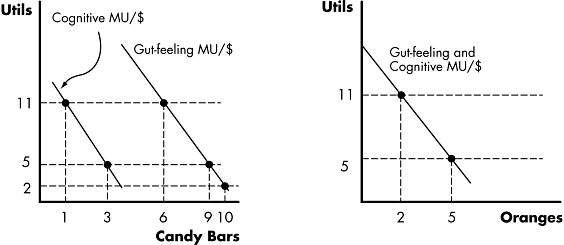

Figure 7.4 The above figure represents the marginal utility per dollar for candy bars and oranges for Sophia. The price of each product is $0.50, and Sophia has a budget of $4.Refer to Figure 7.4. If Sophia goes from making her choice based on gut feeling to making her choice based on cognition, she will:

The above figure represents the marginal utility per dollar for candy bars and oranges for Sophia. The price of each product is $0.50, and Sophia has a budget of $4.Refer to Figure 7.4. If Sophia goes from making her choice based on gut feeling to making her choice based on cognition, she will:

A. increase orange and candy bar consumption. B. decrease orange and candy bar consumption. C. increase candy bar consumption at the expense of orange consumption. D. increase orange consumption at the expense of candy bar consumption.