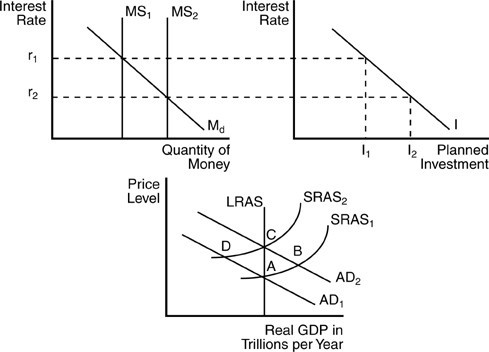

In the above figure, suppose the economy is at a short-run equilibrium at point B and the interest rate is r2. Which of the following policy options for the Fed will help solve the short-run situation?

In the above figure, suppose the economy is at a short-run equilibrium at point B and the interest rate is r2. Which of the following policy options for the Fed will help solve the short-run situation?

A. open market sale of government securities

B. open market purchase of government securities

C. lowering the required reserve ratio

D. lowering the differential between the discount rate and the federal funds rate

Answer: A

You might also like to view...

When the nominal interest rate falls, the opportunity cost of holding money

A) decreases and there is a movement downward along the demand for money curve. B) increases and there is a movement upward along the demand for money curve. C) decreases and the demand for money curve shifts rightward. D) increases and the demand for money curve shifts rightward. E) decreases and the demand for money curve shifts leftward.

Opportunity cost is defined as

A) the highest valued alternative that must be given up to engage in an activity. B) the benefit of an activity. C) the total value of all alternatives that must be given up to engage in an activity. D) the monetary expense associated with an activity.

A concentration ratio provides a better assessment of market power than the Herfindahl-Hirschman index does.

Answer the following statement true (T) or false (F)

According to Angus Madison, a leading authority in the area, world per capita GDP

a. increased by about 50 percent during the 800 years following year 1000 . but it increased by nearly tenfold during the past 200 years. b. increased by nearly tenfold during the 800 years between 1000 and 1813, but it increased by only 50 percent during the past 200 years. c. has grown steadily during the past 1000 years. d. Grew at an annual rate of more than 2 percent during 1000-1813, but the annual growth rate has declined as the population increased during the past 200 years.