One of the commonly used assumptions in deriving the Heckscher-Ohlin model is that tastes are homothetic, or that if the per capita incomes were the same in two countries, the proportions of their expenditures allocated to each product would be the

same as it is in the other country. Imagine that this assumption is false, and that in fact, the tastes in each country are strongly biased in favor of the product in which it has a comparative advantage. How would this affect the relationship between relative factor abundance between the two countries, and the nature (factor-intensity) of the product each exports? What if the taste bias favored the imported good?

If in fact national tastes were strongly biased in favor of the product in which the country enjoyed a comparative advantage, then we would expect a bias in favor of rejecting the Heckscher-Ohlin Theorem in actual trade data. The engine driving the H-O model is that a country should be expected to have a relatively low cost of producing the good in which it has a comparative advantage. However, the respective demand forces would tend to raise the price of this good, so that the expected pattern would not generally be observed. However, if the tastes were biased in favor of the imported good, then the predictions of the Heckscher-Ohlin Theorem would be expected to be generally observed.

You might also like to view...

The concavity or bowed-out shape of the production possibilities frontier is the result of

A. the law of downward-sloping demand. B. the law of upward-sloping demand. C. the principle of increasing cost. D. complementarity in consumption.

The most common type of macroeconomic imbalance is overly expansionary fiscal policies that create large government budget deficits, often financed by a high growth rate of the money supply

Indicate whether the statement is true or false

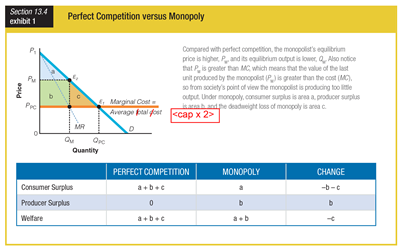

Based on the graphic for perfect competition versus monopoly, the producer surplus for perfect competition is ______ the welfare for perfect competition.

a. greater than

b. less than

c. equal to

d. the opposite of

If inflation is slow to change after an increase in the growth rate of spending, then:

A. real growth must decrease. B. real growth must increase. C. interest rates must decrease. D. interest rates must increase.