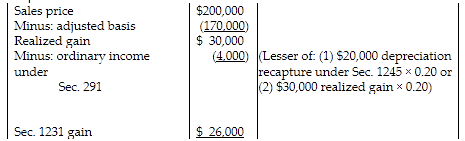

Booth Corporation sells a building classified as a residential rental property for $200,000. The MACRS straight-line depreciation taken is $20,000 and the adjusted basis of the building is $170,000. Booth Corporation must recognize ordinary income of

A) $30,000.

B) $20,000.

C) $4,000.

D) $0.

C) $4,000.

You might also like to view...

A company purchased new furniture at a cost of $16,000 on September 30. The furniture is estimated to have a useful life of 5 years and a salvage value of $2200. The company uses the straight-line method of depreciation. How much depreciation expense will be recorded for the furniture for the first year ended December 31?

A. $3110 B. $910 C. $690 D. $230 E. $800

A floating lien is a security interest in property that was not in the possession of the debtor when the security agreement was executed

Indicate whether the statement is true or false

When difficult people are ignored, they tend to stop their bad behavior.

Answer the following statement true (T) or false (F)

A projected excess cash balance for a month may be ________

A) financed with short-term securities B) financed with long-term securities C) invested in marketable securities D) invested in long-term securities