If policy makers initiate a decrease in the money supply, reductions in government purchases, or increases in taxes, it should drive the economy toward a point on the Phillips curve with ______.

a. higher inflation but lower unemployment

b. higher inflation and higher unemployment

c. lower inflation but higher unemployment

d. lower inflation and lower unemployment

c. lower inflation but higher unemployment

You might also like to view...

The following figures are for the banking system. Deposits at the central bank = 400 U.S. Government Securities = 600 Transactions Deposits = 1,700 Loans = 800 Stockholder's Equity = 70 Other Assets = 450 Other Liabilities = 380 Borrowing from the Federal Reserve = 250 Cash in the Vault = 150 The reserve ratio on transactions deposits = 10% Currency in circulation = 10 The monetary base equals:

a. 80 b. 1,700 c.A multiple of 80 d. A multiple of 250 e. 560

Refer to Figure 11-5. Curve G approaches curve F because

A) marginal cost is above average variable costs. B) fixed cost falls as capacity rises. C) average fixed cost falls as output rises. D) total cost falls as more and more is produced.

The value of all outstanding federal government securities is called

A. the net internal debt. B. the fiscal deficit. C. the budget deficit. D. the public debt.

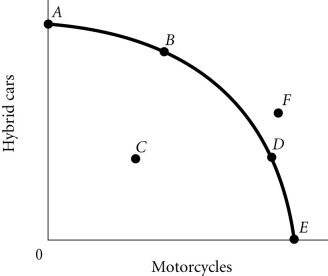

Refer to the information provided in Figure 2.4 below to answer the question(s) that follow. Figure 2.4According to Figure 2.4, a decrease in unemployment may be represented by the movement from

Figure 2.4According to Figure 2.4, a decrease in unemployment may be represented by the movement from

A. B to A. B. C to D. C. B to D. D. A to C.