Tax loopholes

a. reduce the progressivity of the federal income tax.

b. encourage particular patterns of behavior.

c. include exemption of interest earned on municipal bonds.

d. All of the above are correct.

d

You might also like to view...

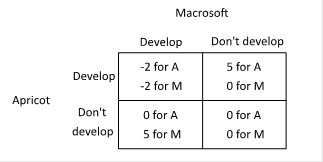

Suppose two companies, Macrosoft and Apricot, and considering whether to develop a new product, a touch-screen t-shirt. The payoffs to each of developing a touch-screen t-shirt depend upon the actions of the other, as shown in the payoff matrix below (the payoffs are given in millions of dollars).  Which of the following statements is correct?

Which of the following statements is correct?

A. Apricot's dominant strategy is to not develop a touch screen t-shift. B. Apricot's dominant strategy is to develop a touch-screen t-shirt. C. Apricot does not have a dominant strategy. D. Apricot's dominant strategy is to develop a touch-screen t-shirt if Macrosoft does not.

In 2005, fewer than one million workers were involuntarily employed on a part-time basis

Indicate whether the statement is true or false

If Canada goes from a large budget deficit to a small budget deficit, it will

a. increase private saving and so shift the supply of loanable funds right. b. increase investment and so shift the demand for loanable funds right. c. increase public saving and so shift the supply of loanable funds right. d. reduce national saving and shift the supply left.

Consumers express self-interest when they:

A. Seek the lowest price for a product B. Reduce business losses C. Collect economic profits D. Exclude others in their thinking